- Home

- |

- Contact Us

-

CitiPhone

CitiPhone

-

Email us

Email us

-

Visit us

Visit us

-

Mail us

Mail us

-

Hardship Assistance

Hardship Assistance

-

Accessibility Services

Accessibility Services

CitiPhone Banking

Citi provides our customers with the power to control their own banking from anywhere, at any time. You have the freedom to do your own banking 24 hours a day, seven days a week, where ever you are in the world at a time that suits you.

FAQs

How to use CitiPhone

Available Services

Your Security

Contact Us

How can I update my contact details?

How can I update my contact details?

To change your contact details, simply sign into Citibank Online and click the 'My Profile' link. This will then display options to change your Contact Details, via an OTP (One Time PIN) login. Changes available to you will include; Email Address, Phone Numbers, Address, and your consent to be contacted by Citibank.

New and Current Applications

New and Current Applications

Customers wishing to provide supporting documentation for Applications can submit their documents directly to our online portal. Please navigate to citibank.com.au/applicationstatus and select 'submitting your supporting documents'. Please then follow the prompts to complete the process.

Customers can also contact us via additional channels;

For Email support, including submission of supporting documents, please direct all queries to newca1@citi.com

Postal Address - Citi Credit Cards and Loans, GPO Box 1625, Sydney, NSW, 2001.

If you wish to speak to a member of the Applications team regarding your application status, or if you have any other queries, please contact us on 1800 807 1381800 807 138.

Getting started is easy and simple, all you need to gain access to self-service phone banking is:

- Your Citi card or your account number

- Your Telephone Personal Identification Number (TPIN)*

- Your registered mobile phone to receive a One-Time-PIN

*If you do not have a TPIN please call us on 13 24 8413 24 84, enter your Card/Account Number, and select option 4 and then 1. Then follow instructions on how to reset TPIN.

1

2

ABC

3

DEF

4

GHI

5

JKL

6

MNO

7

PQRS

8

TUV

9

WXYZ

*

0

+

#

Click button  in demo above to navigate

in demo above to navigate

back to previous menu option.

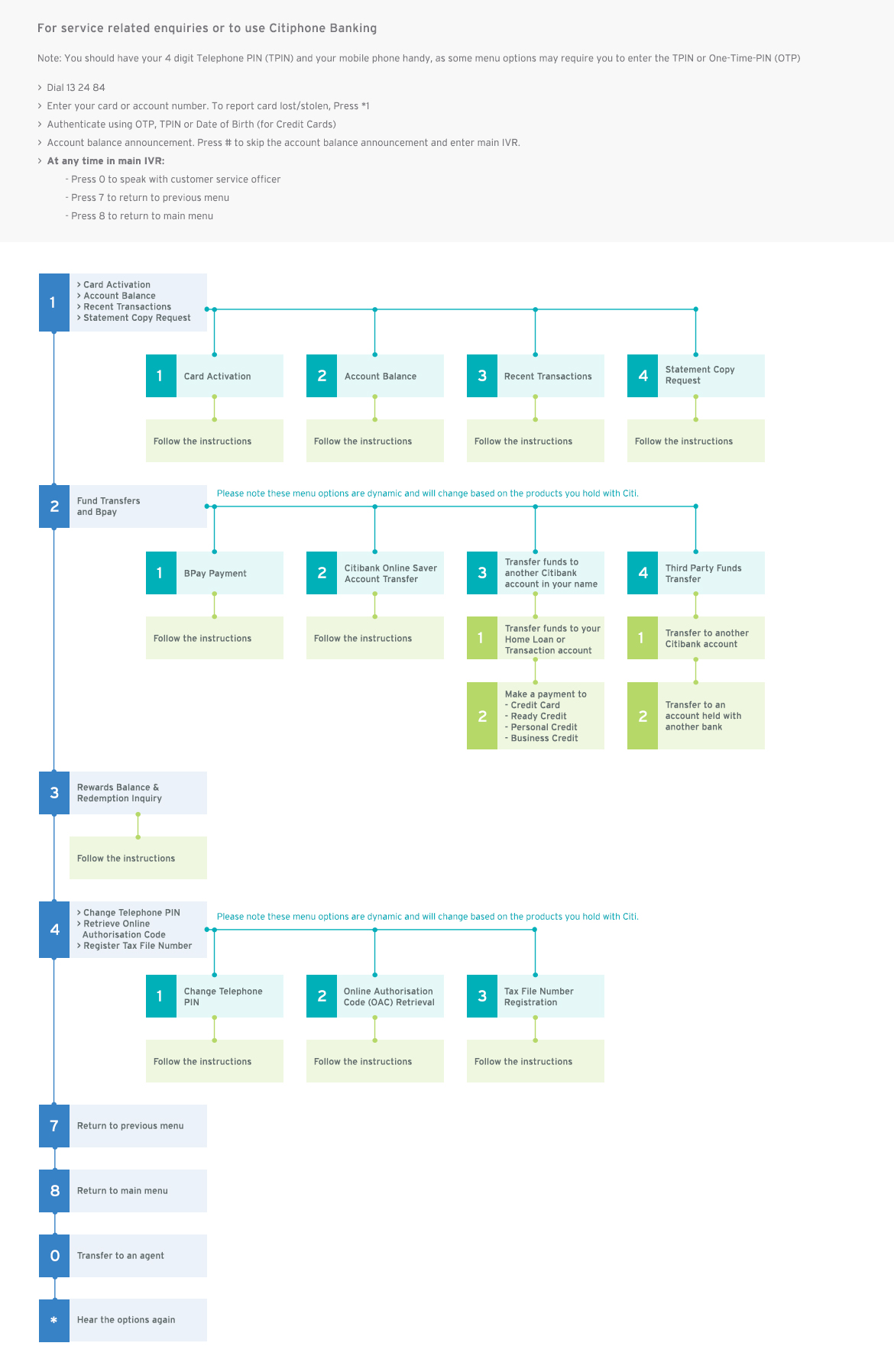

1Card Activation, Account Balance, Recent Transactions, Statement Copy Request

2Funds Transfer and Bpay

3Rewards Balance & Redemption Inquiry

4 Change Telephone PIN, Retrieve Online Authorisation Code, Register Tax File Number

7 Return to previous menu

8Return to main menu

0 Transfer to an Agent

* Hear the options again

1 Card Activation

2 Account Balance

3 Recent Transactions

4 Statement Copy Request

7 Return to previous menu

8 Return to main menu

0 Transfer to an agent

1 Bpay Payment

2 Online Saver funds transfer

3 Internal Account Funds Transfer

4 Third Party Funds Transfer

7 Return to previous menu

8 Return to main menu

0 Transfer to an agent

1 Change Telephone PIN

2 Online Authorisation Code (OAC) Retrieval

3 Tax File Number Registration

7 Return to previous menu

8 Return to main menu

0 Transfer to an agent

1 Transfer funds to Home loan or Transaction account

2 Payment to Credit Card / Ready Credit / Personal Credit / Business Credit

7 Return to previous menu

8 Return to Main Menu

0 Transfer to an Agent

* Hear the options again

1 Transfer Internal to Citibank

2 Transfer External to Citibank

7 Return to previous menu

8 Return to Main Menu

0 Transfer to an Agent

* Hear the options again

| FUNCTIONALITY | Online Banking | Mobile Banking | IN BRANCH | Telephone Banking | ||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

EVERYDAY ACCOUNTS EVERYDAY ACCOUNTS

|

||||||||||||||||||||||||||||||||||||||||||||||||||

STATEMENTS STATEMENTS

|

||||||||||||||||||||||||||||||||||||||||||||||||||

CHEQUES CHEQUES

|

||||||||||||||||||||||||||||||||||||||||||||||||||

CREDIT CARDS CREDIT CARDS

|

||||||||||||||||||||||||||||||||||||||||||||||||||

RATES RATES

|

||||||||||||||||||||||||||||||||||||||||||||||||||

OTHER OTHER

|

||||||||||||||||||||||||||||||||||||||||||||||||||

Telephone PIN (TPIN)

Telephone PIN (TPIN)

When calling Citi, you will be required to enter your Citi card number or account number and your Telephone PIN to perform self-service banking. You can change your Telephone PIN through our self-service menus or by speaking to one of our customer service officers.

Your Telephone PIN should be kept private and secure to ensure that your account information is protected. If you feel that the security of your Telephone PIN has been compromised in anyway, please contact us on 13 24 8413 24 84.

One-Time PIN (OTP)

One-Time PIN (OTP)

The Citi One-Time PIN (OTP) is a unique single use PIN which will be sent as an SMS to your mobile phone.

For added security some transactions in Citiphone Banking require you to enter an OTP in addition to your Telephone PIN (TPIN). You can also use an OTP to quickly and easily identify yourself before transferring to a customer service officer.

Please note, the OTP used in Citiphone Banking is different to a Citibank Online OTP, and cannot be generated using your Citi Mobile App.

What is voice recognition?

What is voice recognition?

Voice recognition, (also known as voice prints, or voice biometrics), are a set of features extracted from a person’s voice. These are unique to every person and closely related to your vocal tract shape and motion patterns.

You can choose to enroll to voice biometrics by speaking to a Customer Service Officer. During the conversation, a voice print will be captured and stored securely. The next time you call, we will compare the voice of the caller to the voice print on file and determine whether there is a match.

To learn more, visit citibank.com.au/vb

What are the benefits of voice recognition?

What are the benefits of voice recognition?

Speed & Convenience - Enrolling in voice recognition will make it quicker and easier for us to identify you. In many cases, it will mean we do not have to ask you additional identification questions.

Fraud Protection - once enrolled, if someone else calls and is pretending to be you, we will be able to see that their voice does not match the print we have on file.

Is voice recognition secure?

Is voice recognition secure?

Yes - Your voice print will be stored in a secure server using industry leading encryption methods and cannot be 'played back'.

What happens if next time I call, I have a cold and my voice is different? How will you identify me?

What happens if next time I call, I have a cold and my voice is different? How will you identify me?

The technology is sophisticated enough that we can still identify you. However, if we are unable to use your voice to identify you, we will use alternate questions to complete the identification. This will depend on the nature of your enquiry.

Does enrolling in voice recognition mean that I won’t have to answer any other additional questions?

Does enrolling in voice recognition mean that I won’t have to answer any other additional questions?

In most cases yes. This will depend on the nature of your enquiry. In certain scenarios, you may be required to answer additional verification questions.

What happens to my Telephone PIN?

What happens to my Telephone PIN?

There are no changes. Your Telephone PIN can still be used both for self-service phone banking and when speaking to a Customer Service Officer.

Can I still identify myself using a One-Time PIN?

Can I still identify myself using a One-Time PIN?

Yes. One-Time PIN is still available when speaking to a Customer Service Officer.

What happens if someone tries to impersonate my voice by playing back a recording?

What happens if someone tries to impersonate my voice by playing back a recording?

The technology is designed to detect such impersonation. Please note, that the verification of your voice happens whilst speaking to a Customer Service Officer, it would not be a natural conversation if the voice is a recording being played back.

Using CitiPhone Banking

Using CitiPhone Banking

Getting started is easy, you can call us on 13 24 8413 24 84 or +61 2 8225 0615+61 2 8225 0615 (if you are calling from overseas).

Please ensure you have the following details handy for self-service phone banking:

- Your Citi Credit card/Debit card number or account number and

- Your registered mobile phone, in order to receive a One Time PIN (OTP) or Telephone Personal Identification Number (TPIN)*

Follow the prompts to access information regarding your account or to speak with a customer service representative.

*If you do not have a TPIN please call us on 13 24 8413 24 84, enter your Card Number/Account Number, select options 5, 1, and then 2 to create your Telephone PIN.

For specific enquiries, please refer to the contact numbers below:

Call Us

Call Us

| Product | Number | Hours |

|---|---|---|

|

Report a Lost or Stolen card Everyday accounts |

13 24 84

13 24 84

+61 2 8225 0615+61 2 8225 0615 (from overseas) |

24/7 |

| Home Loans | 1300 361 9221300 361 922 (New customers) 1300 131 1271300 131 127 (Existing customers) +61 2 8225 0615+61 2 8225 0615 (from overseas) |

9am to 5pm Mon-Fri (AEST)* |

| Citigold | 1800 168 1681800 168 168

+61 2 8225 0618+61 2 8225 0618 (from overseas) |

24/7 |

| Metlife | 1300 555 6251300 555 625 | 8am to 6pm Mon-Fri (AEST)* |

| AIA Australia | 1800 333 6131800 333 613 | 8am to 6pm Mon-Fri (AEST)* |

| OnePath | 1800 016 2841800 016 284 | 8:30am to 6:30pm Mon-Fri (AEST)* |

| AGA Complimentary Insurance | 1800 072 7911800 072 791 | 8am to 5pm Mon-Fri (AEST)* |

| Collections - Credit Cards and Personal Loans | 1300 369 7971300 369 797

+61 2 8604 4713+61 2 8604 4713 (from overseas) |

9am to 9pm Mon-Fri (AEST)* |

| Collections - Home Loans | 1300 300 4701300 300 470

+61 2 8278 8464+61 2 8278 8464 (from overseas) |

9am to 5pm Mon-Fri (AEST)* |

*Excluding Public Holidays

* For Citi Prestige, Signature, Platinum and Emirates Priority service numbers, you can also refer to the number on the back of your credit card

Email Us

| Online enquiry form | Click here to make an enquiry |

| Online Feedback |

Click here to submit a Complaint*, a Compliment or General Feedback. *Click here to view our Complaint Management Policy. |

Visit Us

| Australia | Click here to view our branch locations |

Mail Us

| General | Citi, GPO Box 40, Sydney NSW 2001. |

| Investments | Citibank - Skybranch, GPO Box 40, Sydney NSW 2001. |

| Deposit accounts | Citibank, GPO Box 40, Sydney NSW 2001. |

| Home Loans | Citibank, GPO Box 4799, Sydney NSW 2001. |

| Collections - Credit Cards and Loans | PO Box 3913, Sydney, NSW 2001 |

| Collections - Home Loans | PO Box 40, Sydney, NSW 2001 |

| Insurance | |

| MetLife | GPO Box 3319, Sydney NSW 2001. |

| AIA Australia | PO Box 6111, St Kilda Road Central, VIC 8008. |

| OnePath | 347 Kent Street, Sydney NSW 2001. |

| Cheques & Deposits | |

| Credit cards | GPO Box 5427 Sydney NSW 2001. |

| Deposits | Banking Services, Citibank Pty Ltd, GPO Box 40, Sydney NSW 2001. |

| Ready Credit | GPO Box 5427 Sydney NSW 2001 |

| Home Loans | GPO Box 5347 Sydney NSW 2001 |

Hardship Assistance

| Address: | PO Box 3453, Sydney NSW 2001. |

| Phone Number: | 1800 722 8791800 722 8791800 722 879 (Opening Hours: 9am to 9pm AEST, Monday to Friday, excluding Public Holidays). |

Accessibility Services

For customers who are deaf or have a hearing/speech impairment:

1. National Relay Service - www.relayservice.com.au

2. Telephone Typewriter (TTY) Users - call 133 677133 677; request 02 8225 061502 8225 0615.

3. Speak and Listen Users - call 1300 555 7271300 555 727; request 02 8225 061502 8225 0615.

4. Internet Relay Users - connect to the NRS website www.iprelay.com.au/call/index.aspx; request 02 8225 061502 8225 0615.

5. Translation and Interpreting Services – call 1800 131 450; website www.tisnational.gov.au